Venture capital investors interested in university-based enterprises

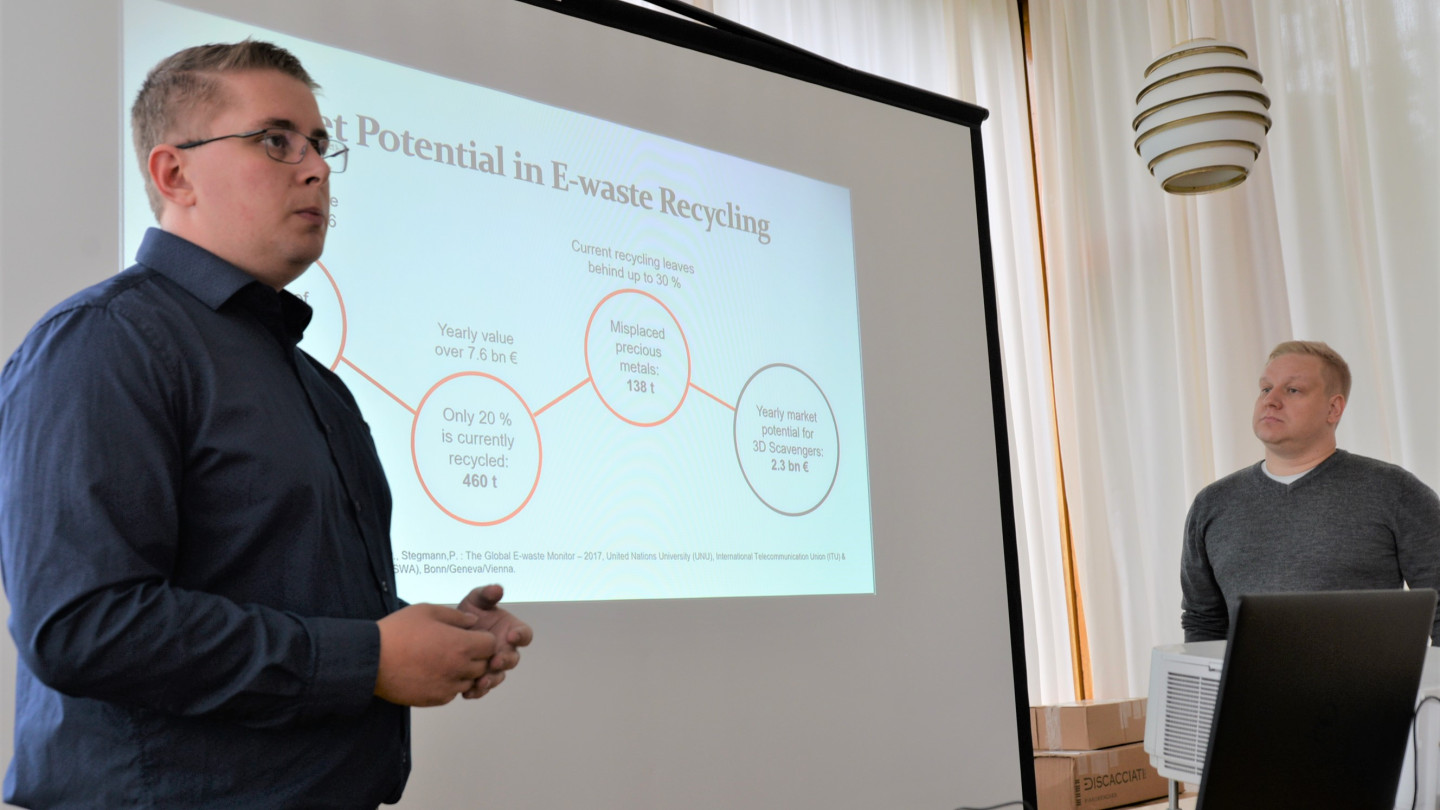

Raising a funder’s interest is important for a start-up company. “Tentative contacts, views about the business idea and further plans are valuable for the future,” says Elmeri Lahtinen from WeeeFiner Oy. The business idea of this company is based on collecting valuable metals and removing harmful metals, taking advantage of an innovation made at the Department of Chemistry. “The day served as an excellent opportunity to introduce yourself and as a start of discussions with capital investors,” Lahtinen continues.

“In the research-based start-ups of JYU, we can see especially the cross-disciplinary character of innovations as well as multidisciplinary expertise as strengths. The next step is to develop teams up to the international level,” summarises Inka Mero, a Managing Partner of venture capital firm Voima Ventures.

Petri Laine and Juho Risku agree that commercial views and support are needed.

“There were interesting business ideas and world-class technology on display, but most teams did still lack business and sales expertise,” says Petri Laine from Innovestor Ventures. “Often the business plan has to be revised along the way, and that is when experience bears great significance,” he continues.

“The stronger the technological background is, the weaker business and entrepreneurial experience the start-up often has,” says Juho Risku from Butterfly Ventures. “It is common that a start-up company is playing with its own strengths only. On the other hand, tackling the shortcomings, in particular, can enable a most significant upward qualitative leap. As a whole, the event was interesting and rewarding, absolutely worth continuing as an operational model.”

The university-based companies participating in the Venture Capital sparring on 17 September 2020 included WeeeFiner Oy, Howspace Oy, BiopSense Oy, Psyon Games Oy, and Binare Oy. The companies presented their plans and received expert feedback, also critical, from the VC investors. The venture capital investors present at the event were Butterfly Ventures, Innovestor and Voima Ventures. Also representatives of The Startup Factory, Unifund and the University of Jyväskylä attended the event.

Further information:

Vesa Kupari, CEO,

Unifund Jyväskylä Ltd

tel. 0400 616 940

vesa.kupari@jyu.fi

jyu.fi/unifund